2018 AHP Equine Industry Survey Results Report [download PDF]

2018 AHP Equine Industry Survey Report was prepared by C. Jill Stowe, PhD, Dept. of Agricultural Economics (University of Kentucky) as a consultant to AHP. Dr. Stowe has provided consultation and data analysis services to AHP for all four of the AHP Equine Industry Surveys.

American Horse Publications (AHP) conducted its fourth online nationwide equine industry survey from January 22, 2018, through April 1, 2018. The survey’s three main objectives are: 1) to gauge participation trends and management practices in the U.S. equine industry; 2) to identify critical issues facing the equine industry as perceived by those who own or manage horses; and 3) to better understand approaches to horse health care. The survey was designed and administered using SurveyMonkey, a web-based survey platform.

Upon conclusion of the survey, 9,629 responses were collected. After removing responses from 617 participants who did not currently own or manage any horses, there were 9,012 usable responses. Potential respondents were made aware of the survey through online and print notifications from AHP members as well as via social networking tools such as Facebook and Twitter. In addition, those providing their email addresses in previous surveys were invited to participate via email. 43.4% of the original 9,629 responses were generated from the email invitation, but it is likely that a greater percentage are previous respondents, since some individuals accessed the survey from the weblink rather than the email invitation.

This report summarizes the results from the five main sections of the survey: respondent demographics, horse ownership, horsekeeping costs, issues facing the equine industry, and horse health care. Complete results from each question are available on request by AHP members or purchase by a non-member for a fee.

Demographics

The first section of the survey collects information on respondent demographics. The survey sample obtained this year is skewed more heavily toward the older age groups than previous surveys. Only 5.5% of respondents were in the 18-24 years age group (down from nearly 10% in 2015), while 19.1% of respondents were in the 65+ years age group (up from 11.1% in 2015). The percent of respondents in the 25-34 and 35-44 years age groups were roughly the same as in previous surveys but significantly lower than the percent of horse owners in those age groups estimated in the recently released American Horse Council (AHC) Foundation Economic Impact of the U.S. Horse Industry report. That study provides the following age distribution among horse owners using somewhat different age categories: less than 18 years – 12%; 18-24 years – 5%; 25-34 years – 22%; 35-44 years – 20%; 45-59 years – 23%; 60-74 years – 17%; 75+ years – 2% (Economic Impact of the U.S. Horse Industry, p. 28). Overall, in the AHP 2018 survey sample, 70.5% of respondents are age 45+, compared to 42% in the AHC report. Notably, the AHP 2018 survey did not permit individuals under the age of 18 to respond to the survey.

Nearly identical to the previous AHP study in 2015, 92.6% of the respondents are female.

The majority of respondents (52.9%) live in households with 2 members, and 95.2% of the respondents live in households with no more than 4 members. Most respondents (53.4%) report only one member of the household being involved with horses, while another 35.7% report two household members being involved with horses.

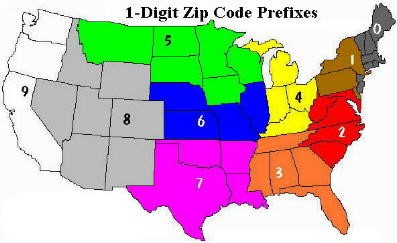

The income distribution among respondents is skewed towards the higher income brackets relative to previous surveys. This difference may be due to general income growth or may be a factor of the different age distribution of respondents. 43.0% of the survey participants reported annual household income before taxes of less than $75,000; 16.5% of the respondents had annual household income of at least $150,000. Tab 1 illustrates the annual household income distribution by zip code region. Region 7 has the highest percentage of respondents in the highest income range ($150,000+), while region 6 has the lowest. Region 4 has the highest concentration of respondents in the lowest income range (< $50,000), while region 0 has the lowest. Region 0 has the highest concentration of respondents in the combined $100,000+ range while at the same time being an area with one of the highest costs of living in the U.S.

The geographical distribution of responses is relatively uniform. Respondents are categorized into 10 regions based on the first digit of their reported zip code. Table 1 below provides a description of these “zip code regions”; moving from region 0 to region 9 can loosely be thought of as moving from east to west across the United States. Figure 1 illustrates these regions for the continental U.S. Alaska (20 respondents) and Hawaii (10) are included in region 9, and respondents from U.S. Territories (5) are included in regions 0 or 9 depending on location. The largest number of responses came from zip code region 9 (15.4%); the smallest number of responses came from zip code region 6, which constitutes 6.7% of the responses.

Table 1 – Zip code regions and their corresponding states

| Zip Code Region | Zip Codes Included | States Included |

| 0 | 00000-09999 | CT, MA, ME, NH, NJ, PR, RI, VT |

| 1 | 10000-19999 | DE, NY, PA |

| 2 | 20000-29999 | District of Columbia (DC), MD, NC, SC, VA, WV |

| 3 | 30000-39999 | AL, FL, GA, MS, TN |

| 4 | 40000-49999 | IN, KY, MI, OH |

| 5 | 50000-59999 | IA, MN, MT, ND, SD, WI |

| 6 | 60000-69999 | IL, KS, MO, NE |

| 7 | 70000-79999 | AR, LA, OK, TX |

| 8 | 80000-89999 | AZ, CO, ID, NM, NV, UT, WY |

| 9 | 90000-99999 | AK, AS, CA, GU, HI, MH, FM, MP, OR, PW, WA |

Horse Ownership

The second section of the survey focuses on horse ownership and horse industry involvement. 98.5% of the respondents indicate that they are horse owners, and 20.6% identify themselves as barn/farm managers. 57.8% of respondents indicate that they are pleasure riders, while 32.5% indicate that they ride competitively. 14.1% of respondents indicate that they are riding instructors, 15.0% report being horse trainers, and 12.8% are breeders. Among the more frequently mentioned forms of involvement in the “other” category are 4-H/Pony Club leader, artist (photography, etc.), communications/media/writing, and professional service provider (accountant, attorney, etc.).

Respondents were asked to identify the number of horses they currently own and/or manage in four different age groups: foals (less than 1 year old), young horses (1-4 years old), mature horses (5-15 years old), and senior horses (16+ years old). Respondents in the survey own an average of 0.25 foals, 0.68 young horses, 3.24 mature horses, and 2.37 senior horses, for an overall average of 6.56 horses per respondent. The overall average number of horses owned/managed is nearly identical to the figure in the 2015 survey and less than the average of 7.41 in the 2012 survey. Respondents report owning/managing an average of 2.16 horses each that are idle, retired, or otherwise not working.

Over three-quarters (77.1%) of respondents indicate that none of their horses are insured, while nearly 8% report that more than 75% of their horses are insured. The percentage of uninsured horses has been nearly identical across the four surveys.

Horses Owned/Managed

One of the objectives of this survey is to understand how respondents’ participation with horses and in the horse industry has changed and how they expect it to change in the future. Initially, the focus is on trends in the number of horses owned and/or managed.

73.5% of the respondents indicate that the number of horses they currently own/manage is the same as it was last year (in 2017). About 12% of respondents own/manage more horses than they did last year, while the remaining 14.5% own/manage fewer horses than they did last year. Since the 2012 survey, the percent of respondents reporting the same number of horses as the previous year has increased. When considering their future expectations on horse ownership, 69.2% of respondents expect to own/manage the same number of horses next year (in 2019), 19.2% expect to own/manage more, and 11.6% expect to own/manage less. These numbers are similar to the 2015 study.

Similar to the 2015 study, the average number of horses owned/managed generally increases as one moves away from the coasts and toward the center of the U.S., with the average number of horses owned/managed peaking at 7.9 in zip code region 5. In addition to any demographic factors, this pattern may be explained in part by average land prices, cost of living, and number of acres devoted to permanent pasture and rangeland. Table 2 reports average regional land prices, average regional cost-of-living indices, and average regional acres of permanent pasture and rangeland. All three factors show a fairly strong correlation to average number of horses owned/managed, with average land prices representing the strongest correlation.[1]

Table 2. Factors affecting the average number of horses owned/managed by zip code region

| Region | Average Number of Horses Owned/Managed | Average Land Price Q1 2016a | Average Cost-of-Living Indexb | Average Number of Acres of Permanent Pasture and Rangelandc |

| 0 | 5.7 | $82,108 | 108.7 | 60,801.1 |

| 1 | 5.7 | $109,809 | 112.3 | 515,648.3 |

| 2 | 6.4 | $203,393 | 117.4 | 1,083,736.2 |

| 3 | 6.6 | $49,654 | 95.0 | 2,411,919.6 |

| 4 | 6.9 | $33,151 | 106.9 | 1,312,202.8 |

| 5 | 7.9 | $56,297 | 110.7 | 12,716,409.2 |

| 6 | 7.7 | $26,290 | 97.0 | 11,440,352.8 |

| 7 | 7.3 | $26,893 | 90.9 | 28,650,486.5 |

| 8 | 7.1 | $114,316 | 99.1 | 17,940,404.3 |

| 9 | 5.4 | $319,084 | 114.6 | 5,672,999.0 |

| Correlation coefficient between # of horses owned and factor in column | -0.66 | -0.53 | 0.61 | |

aObtained from the Lincoln Institute of Land Policy (https://datatoolkits.lincolninst.edu/subcenters/land-values/land-prices-by-state.asp)

bObtained from the Missouri Economic Research and Information Center (https://www.missourieconomy.org/indicators/cost_of_living/)

cObtained from Table 8 in the 2012 USDA Census of Agriculture state reports (https://www.agcensus.usda.gov/Publications/2012/Full_Report/Volume_1,_Chapter_1_State_Level/)

Individuals in the highest income bracket ($150,000+) own the most horses on average (7.0), followed closely by those in the lowest income bracket (< $50,000). Those with income in the $125,000 – $149,999 range own the least (5.8). Finally, the average number of horses owned/managed by age group shows less variability than in the 2015 study; the range of averages in the current study is 6.4 – 6.8.

The highest percentage of respondents owning/managing more horses in 2018 than in 2017 are in zip code regions 5 (14.0%) and 4 (13.0%%). The highest percentage of respondents managing fewer horses in 2018 than in 2017 are in zip code regions 7 (17.1%) and 8 (16.6%). Incidentally, regions 7 and 8 were the ones in which the highest percent of respondents owned more horses in the 2015 survey. The highest percentage of respondents expecting to own/manage more horses in 2019 than in 2018 are in zip code regions 7, 8, and 4 (23.7%, 21.5%, and 21.4.%, respectively). The highest percentage of respondents expecting to own/manage fewer horses in 2019 are in zip code regions 7, 5, and 4 (15.5%, 14.2%, and 13.6%, respectively).

Respondents in the highest two income categories reported a higher frequency of owning/managing more horses than they did in 2017 (13.7% and 13.9%), while respondents in the lowest three income categories were most likely to own/manage fewer horses in 2018 than they did in 2017 (15.5%, 15.1%, and 15.8%). Respondents in the < $50,000 income category were most likely to expect to own/manage more horses in 2019 (21.2%), followed by respondents in the $75,000 – $99,999 income category (21.1%). Respondents with income in the $125,000 – $149,999 range were most likely to own/manage fewer horses in 2019 than in 2018 (13.3%).

There is a clear trend when examining horse ownership by age. The frequency of owning/managing more horses in 2018 than in 2017 decreases consistently by age category; 24.5% of respondents in the 18-24 age category report owning/managing more horses in 2018 than in 2017, while only 7.1% of respondents in the 65+ age category report owning/managing more horses. This pattern is also consistent with expectations on horse ownership/management one year in the future: 39.1% of respondents in the 18-24 age category expect to own/manage more horses in 2019 than they do this year, while only 9.0% of respondents in the 65+ age category report the same expectation. These trends are similar to previous surveys, although the magnitude of the response rates differ slightly. Both trends bode well for the future of the industry – an active group of younger participants is essential for the equine industry to remain healthy and growing.

Use of Horses

Survey participants were asked to identify all types of activities they used their horses for. 68.6% of the respondents report pleasure/trail riding with their horses, which continues a marginal downward trend since the first survey (73.5% in 2010, 73.0% in 2012, and 71.7% in 2015). The next most commonly identified “use” is idle, retired, or otherwise not working (31.3%, up from 29.4% in 2015), followed by dressage (27.0%, close to the 27.5% reported in 2015). Lessons or training (23.0%) is the only other activity that received a response of more than 20%. Among the activities/uses listed in the “other” category, those frequently mentioned include art (such as photography and videography), competitive trail riding, and western dressage.

Pleasure/trail riding is the most frequently reported activity with horses in all ten regions. Horses who are idle, retired, or otherwise not working represent the second most frequently reported “activity” in all but two regions, where dressage ranks second. While the pattern isn’t entirely consistent, in general, it appears that a higher percentage of respondents report participating in many of the primarily English disciplines (such as dressage, eventing, foxhunting, and hunter/jumper) on the eastern side of the U.S. Conversely, a higher percentage of respondents report participating in many of the primarily Western disciplines (such as cutting, reining, rodeo, and roping) on the western side of the U.S.

Competitions

Survey participants indicate that they expect to compete in an average of 5.0 events in 2018, which is slightly less than the 5.4 competitions reported in the 2015 study. Nearly 40% of the respondents (38.7%) do not plan on competing at all in 2018. Among those expecting to compete at least once, the average expected number of competitions is 8.2. For the third consecutive survey, respondents living in region 7 reported competing significantly more than those in all other geographic locations. In general, the number of competitions increases with income but decreases with age of the respondent.

Respondents were more likely to compete more in 2018 than in 2017 as income increased and as age decreased. Income category does not seem to predict changes in number of competitions expected in 2019, but age group appears to be a significant factor, with younger age groups being significantly more likely to compete more in 2019.

Preferred Sources of Equine Information

A new question to the survey asked respondents to identify their top three sources for accessing general equine information. Among the options provided, three garnered at least a 60% response: equine magazines (67.0%), company/product websites (65.3%), and social media (60.2%). Many respondents indicated their preference for having an “other” option provided; that will be included the next time the survey is conducted.

Horsekeeping Costs

Survey participants were asked to identify areas in which costs of horsekeeping had increased the most. That question was followed up with an opportunity for respondents to indicate potential ways in which they would accommodate any cost increases.

Feed (including both hay and concentrate) was the most frequently identified area in which horsekeeping costs had increased, but the response rate of 57.3% has steadily declined since its peak at 81.8% in the 2012 survey. Feed costs were followed by the costs of veterinary services (41.1%) and animal health products (34.7%). This is the same ranking as the 2015 survey. Fuel received only a 21.6% response rate, down from 71.4% in 2012.

There are no clear geographical trends, but the data suggest that horse owners and managers in different parts of the country have difference management concerns related to keeping horses.

Given that few respondents (11.0%) don’t expect horsekeeping costs to increase in the future, owners and managers will need to utilize different approaches to cope with expected increased costs. Similar to previous surveys, most respondents (61.6%) indicate that they will reduce expenditures in other areas of their lives to cope with the increased horsekeeping costs. 26.8% of the respondents will consider attending fewer competitions, and 25.1% will pursue opportunities to increase their current income. 20.3% of respondents indicate that they will reduce the number of horses they maintain. These response rates have remained fairly stable across the four AHP surveys.

Issues Facing the Equine Industry

For the fourth consecutive survey, the issue of unwanted horses was identified by the most respondents as one of the top three issues facing the equine industry (37.8%). However, the percent of respondents selecting this option has fallen significantly since the 2015 study, and in this study, it barely edged out the cost of horsekeeping (36.4%) to maintain the first spot. Two land-related issues, loss of trails and riding areas (29.5%) and competition for open space (27.8%), represent the next two most frequently selected issues.

The unwanted horse issue ranks first for all regions except region 0 and region 9; the cost of horsekeeping is the top-ranked issue and may be a due to these areas having among the highest land prices and cost-of-living indices in the country. Land-related issues also rank highly in most regions. All regions selected lack of education material on horses the least.

Land-related issues and lack of a unified voice for the horse industry in Washington, D.C., are more likely to be identified as important issues as respondent age increases. Illegal medication of performance horses, lack of educational materials on horses, overbreeding, owners who don’t understand horses, and unethical horse trainers are less likely to be identified as important issues as respondent age increases.

Horse Health Care

Similar to the 2015 study, nearly 75% of respondents keep at least one horse on their own property, and about 45% board at least one horse at another facility. Among those who keep at least one horse on their own property, 94% make emergency horse health care decisions themselves. This number is significantly higher than the 72% response rate from 2015. Among those who board at least one horse elsewhere, about 50% make the emergency health care decisions for their horses; this figure is less than the 63% from the 2015 survey. More respondents report that the barn/farm manager makes the emergency health care decisions for the horse in 2018 (11%) than in 2015 (3%). Some of the differences in results on both questions may be at least partly attributed to a change in wording of the question (the word “emergency” was added for the 2018 study). Many others make those decisions in conjunction with the barn/farm manager.

Vaccinations

Respondents report that veterinarians administer their horses’ vaccines about 63% of the time, continuing a slight upward trend from the previous two surveys (58.2% in 2012 and 61.4% in 2015). The percent of respondents who administer the vaccines themselves continues to decrease, standing at 29.7% and compared to 31.5% in 2015 and 34.7% in 2012. About 2% of respondents report not vaccinating their horses. Horse owners/managers frequently discuss what their horse is being vaccinated for (79.2%) with their veterinarian. About 47.4% discuss the number of vaccines their horses will receive, and 44.6% discuss what to expect when vaccinating. 46.7% of respondents report discussing AAEP vaccination recommendations with their veterinarians, which represents a substantial increase from 27.3% in the 2015 study.

Just over 80% of the respondents purchase vaccines from their veterinarian. The percent of respondents purchasing equine vaccines from a chain store roughly doubled compared to the 2015 survey, while the percent of respondents purchasing vaccines from a local feed store fell by nearly the same amount. Some of the differences in response rates may be due to clarifying the description of a chain store in the 2018 version of the survey.

About 80% or more of respondents vaccinate their horses against the core diseases (rabies, West Nile virus, Western and Eastern equine encephalomyelitis, and tetanus) at least once a year. Among the risk based-diseases, about 80% of respondents vaccinate their horses against equine herpesvirus and equine influenza at least once a year, and more than 20% of respondents report vaccinating against these two diseases at least twice a year. Respondents vaccinate against other risk-based diseases at least once a year accordingly: strangles (40.0%), Venezuelan equine encephalomyelitis (38.0%), Potomac Horse Fever (33.8%), leptospirosis (19.8%), and botulism (16.1%).

About 20% of respondents report requesting a specific brand of vaccine when purchasing vaccines, a figure which has doubled from the 2015 study. About 70% of respondents indicate that their veterinarian is the leading influence for where they purchase their equine vaccines, with price being the second leading influence (14.7%).

Deworming

The percent of respondents reporting that they deworm their horses once, twice, or three times a year, respectively, has been increasing since 2012, while the percent of respondents reporting that they deworm their horses four times a year or every other month (six times a year) has been decreasing since 2012. This suggests that horse owners and managers are responding to the message that rotational deworming is no longer the recommended approach to deworming. Nearly 80% of respondents are concerned about drug resistance in parasites.

Among the respondents reporting “other” deworming frequencies, most indicate that they perform fecal egg count tests and deworm according to the test results. Given this, they didn’t feel their response fit neatly into the answer choices provided.

About half of the respondents (49.9%) indicate that their veterinarian is involved in developing their horses’ deworming schedules, which is about the same as the 2015 study. However, after hovering just below 50% in the 2012 and 2015 surveys, nearly 78% of 2018 respondents indicate that their veterinarian has recommended a fecal egg count test, with about 63% actually having had a fecal egg count test performed for at least one horse.

Ivermectin is still the most frequently used dewormer (70.0%), although the percent of respondents using ivermectin has steadily decreased since the 2012 survey. Ivermectin/praziquantel is the second most frequently used dewormer (1.4%), followed by fenbendazole single dose (50.9%). Moxidectin/praziquantel is the only dewormer experiencing increasing use since the 2012 study, standing at 30.5% in this year’s study.

Most respondents purchase deworming products from chain stores (46.4%), followed by online (36.7%) and local feed stores (36.5%). This is a change from the 2015 survey, which again may be due to the clarification on the chain store descriptor. Veterinarians are reported to have the most influence on purchasing dewormers (39.6%). Information from equine media was selected as the second leading influence (18.1%), and price was identified as the third leading influence (17.9%).

Calming Products

Just over half (51.5%) of respondents report using either a prescription or non-prescription calming product for their horses. This is a new question to the survey; however, the 2015 survey asked whether respondents had ever used a sedative or tranquilizer product for their horse (with a focus on prescription calming products), with 70% answering affirmatively.

Horse owners and managers purchase calming products from a variety of sources, and the source likely depends on whether they are purchasing a prescription or non-prescription product. Just over 40% report purchasing these products online, and 35.5% report purchasing calming products from their veterinarian.

Among the respondents that had used either a prescription or non-prescription calming product, just under 90% had used at least one non-prescription calming product. Quietex (26.9%) and Mare Magic (26.6%) were the only two products used by at least 20% of respondents. Nearly one-quarter of respondents indicated that they had used a non-prescription calming product not listed among the answer choices, with some of the more commonly reported products being those not necessarily developed specifically for horses such as essential oils and dried raspberry leaves. Riding in a new environment was the most frequently selected horse care procedure (44.1%) for which these calming products were used, followed by trailering (21.1%) and long-term stall rest (16.0%). One commonly reported use in the “other” answer choice was for managing holiday fireworks.

Among the respondents that had used either a prescription or non-prescription calming product, just over 60% had used at least one prescription calming product. All answer choices provided were utilized with regularity, although the greatest percent of respondents report using acepromazine (42.1%). Prescription calming products were used most frequently for dental exams (52.5%), veterinary procedures (44.1%), and first aid procedures (22.7%). Here, too, respondents often reported using prescription calming products to help their horses deal with holiday fireworks.

New Technologies and Therapies

Respondents were asked if they had ever considered using wearable horse technology. Just over 90% reported not having considered such technology. Among the answer choices provided, 3.6% reported using the NightWatch halter, and 3.1% reported using various other types of horse technology.

The final question of this year’s survey asked respondents if they had utilized any alternative or complementary therapies for their horse(s) in the past year. Almost 60% had utilized at least one form of therapy. The most frequently utilized therapy was chiropractic manipulation (42.8%), followed by massage therapy (32.5%), acupuncture (17.5%), and magnetic therapy (12.3%). Just over 8% of respondents reported using a wide variety of other types of therapies.[2]

Summary

The 2018 AHP Equine Industry Survey builds upon the 2009-2010, 2012, and 2015 surveys to help understand the trajectory of the equine industry.

Five main results conclusions can be drawn from this year’s study:

- Continuing the trend from the 2015 study, the U.S. equine industry appears to remain fairly stable based on numbers of horses owned/managed and numbers of competitions. The overall average number of horses owned/managed is about the same as 2015, with slightly more senior horses and idle horses. Over 85% of respondents own/manage the same number or more horses than in 2017, and over 80% expect to own/manage the same number or more horses in 2019. Moreover, about 93% of respondents who competed (or plan to compete) in 2018 are competing the same amount or more than they competed in 2017, and about 93% also plan to compete the same amount or more than they compete in 2018. In addition, participants in the youngest age groups expect to own/manage more horses and compete more in the future.

- Costs of horsekeeping are increasing in different areas. In this year’s survey, veterinary services, labor costs, and animal health products represent the three areas in which costs have increased the most for horse owners/managers. To some extent, these cost differences are geographical, suggesting a needed awareness of different management concerns across the country.

- Unwanted horses will always be an important issue to the equine industry, but land-related issues (loss of trails/riding areas and competition for open spaces from developers and other agricultural uses) are continually becoming more important to respondents.

- There have been changes in horse health care management and awareness. Nearly double the percent of respondents are now talking to their veterinarians about AAEP vaccination recommendations, and the percent of respondents requesting specific brands of vaccines has also doubled. In addition, more respondents are deworming less frequently, which suggests that more horse owners/managers are adopting the approach of utilizing fecal egg count tests and deworming according to the results in favor of rotational deworming.

- Science and technology have provided new opportunities to better care for the horses we manage. New product and therapy development give rise to different opportunities for growth in the industry, which does not necessarily have to be measured strictly by number of horses.

According to past and present AHP survey results, nearly ten years removed from the onset of the Great Recession of 2008-2009, the equine industry appears to have firmly stabilized. Industry participants have made great strides in addressing important issues, such as the unwanted horse issue, and now have their sights focused on additional challenges, such as the scarcity of riding areas and open spaces.

References

Economic Impact of the U.S. Horse Industry. (2018) American Horse Council Foundation, Washington, DC.

Thirkell, Jack and Rebecca Hyland (2017). “A Survey Examining Attitudes Towards Equine Complementary Therapies for the Treatment of Musculoskeletal Injuries.” Journal of Equine Veterinary Science 59, 82-87.

[1] In absolute value, correlation coefficient estimates closer to one indicate a stronger linear relationship. A positive (negative) sign indicates that two variables move in the same (opposite) direction.

[2] Thirkell and Hyland (2017) conducted a survey aimed at horse owners in the United Kingdom to investigate the use of complementary and alternative veterinary medicine for equine musculoskeletal disorders. In their study, the three most popular therapies were massage therapy (71%), chiropractic manipulation (58.6%), and magnetic therapy (53.7%)

Full results including the summary report, supplemental data, and charts are available to AHP members on request. Eligible non-members may join AHP to receive the complete survey files as a member benefit or non-members may obtain the complete survey files for a fee of $500. To request the files or order, contact Chris Brune at amy.sales@easterassociates.com.

The online survey is made possible by a sponsorship from Zoetis, the leading animal health company dedicated to improving equine wellness, every day. Zoetis has sponsored the survey since its inception in 2009. For additional key survey findings on horse health, read the release from Zoetis: Horse Owners Place Significant Trust in Their Veterinarian, New Survey Reveals

Excerpts from this study must be referenced as “2018 American Horse Publications (AHP) Equine Industry Survey sponsored by Zoetis.”